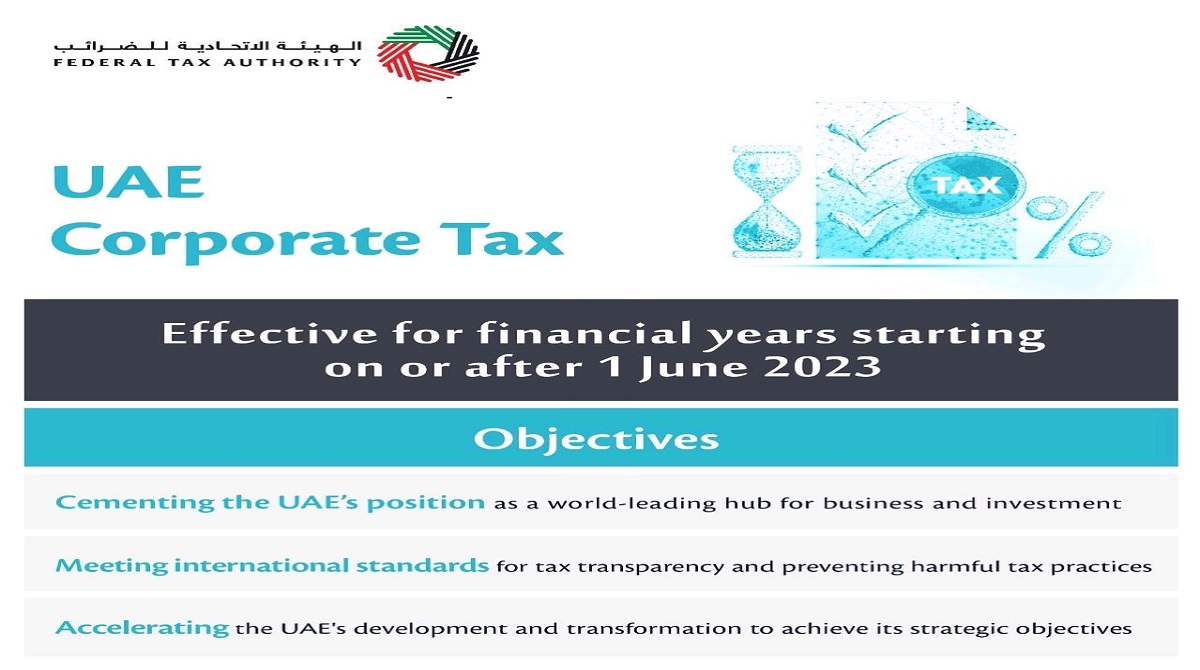

UAE CORPORATE TAX

Effective for Financial years starting on or after 1 June 2023

The Ministry of Finance to introduce federal corporate tax on business profits that will be effective for financial years starting on or after 1 June 2023.

Tax Rate :

With a standard statutory tax rate of 9% and a 0% tax rate for taxable profits up to AED375,000 to support small businesses and startups, the UAE corporate tax regime will be amongst the most competitive in the world.

Key Features:

No corporate tax will apply on personal income from employment, real estate and other investments, or on any other income earned by individuals that does not arise from a business or other form of commercial activity licensed or otherwise permitted to be undertaken in UAE.

Corporate tax will apply on the adjusted accounting net profit of the business.

Free zone business that meet all necessary requirements can continue to benefit from corporate tax incentives.

The extraction of natural resources will remian subject to Emirate level corporate taxation.

No withholding tax will apply on domestic and cross border payments.

No corporate tax will apply on capital gains and dividends received by a UAE business from its qualifying shareholdings.

No corporate tax will apply on qualifying intragroup transactions and restructurings.

Foreign tax will be allowed to be credited against UAE corporate tax payable.

Generous loss transfer and utilisation rules will be available to businesses.